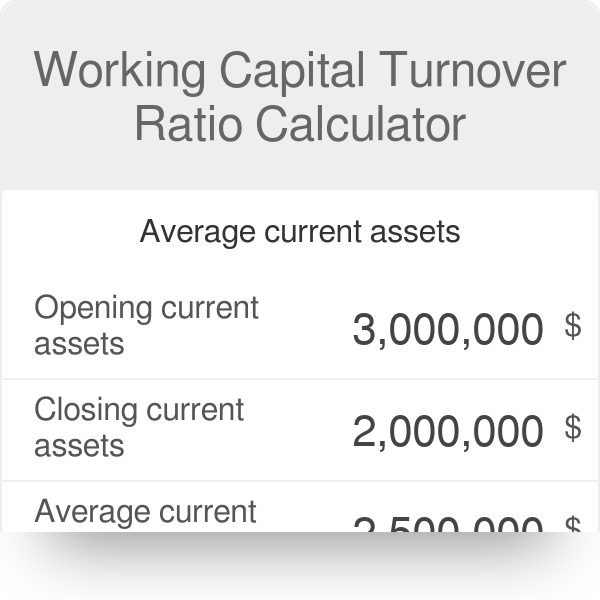

working capital turnover ratio calculator

However a capital-intensive company will have a different ratio and in the case of negative working capital the ratio might reverse in most cases. But an extreme higher ratio may also have drawbacks attached to it.

Working Capital Turnover Ratio Formula Calculator Excel Template

Suppose a business had 200000 in gross sales in the past year with 10000 in returns.

. Working Capital Turnover Ratio Cost of Sales Net Working Capital. After all bills and debt installments have been paid. The formula to determine the companys working capital turnover ratio is as follows.

This ratio needs to be used in conjunction with other ratios especially inventory turnover to make an informed decision. Together with ratios such as inventory turnover accounts receivable turnover the working capital turnover ratio is a key metric in working capital management. The Working Capital Turnover Ratio indicates how effective a company is at using its working capital.

If this ratio is around 12 to 18 This is generally said to be a balanced ratio and it is assumed that the company is in a healthy state to pay its liabilities. Current Liabilities 30000. We calculate it by dividing revenue by the average working capital.

Example of the Working Capital Turnover Ratio. Working Capital Turnover Ratio Formula. 150000 divided by 75000 2.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Working capital can be calculated by subtracting the current assets from the current liabilities like so. It signifies how well a company is generating its sales concerning the working capital.

A ratio of 2 is typically an indicator that the company can pay its current liabilities and still maintain its day-to-day operations. This means that XYZ Companys working capital turnover ratio for the calendar year was 2. 100000 40000.

Similarly a lower ratio depicts poor management of short-term funds. High working capital turnover ratio is an indicator of efficient use of the companys short-term assets and liabilities to support sales. Working Capital Turnover Ratio Formula Calculator Excel Template The sales for the period were 300000 so the receivable turnover ratio would equal 3 meaning the company collected its receivables three times for that period.

What It Is And How To Calculate It Before we can understand the working capital turnover ratio we must first understand what working capital is. If Working Capital Turnover stays the same over time. A higher ratio indicates higher operating efficiency where every dollar of working capital generates more revenue.

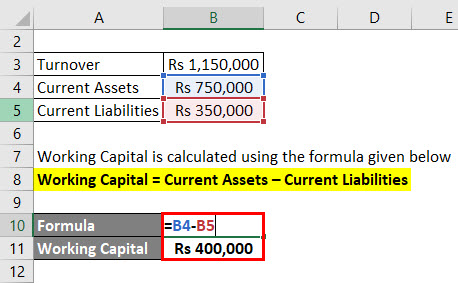

That said the business made 190000 in net sales. Working Capital Ratio Current Assets Current Liabilities. Working Capital Current Assets - Current Liabilities.

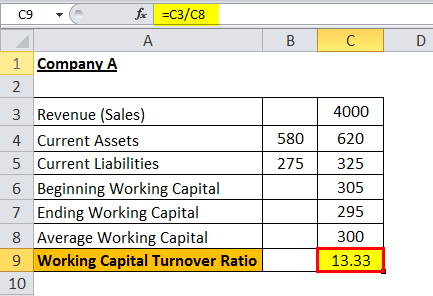

Also known as net sales to working capital working capital. ABC Company has 12000000 of net sales over the past twelve months and average working capital during that period of 2000000. Working Capital Turnover Ratio.

The companys working capital is the difference between the current assets and current liabilities of a company. The Working Capital Turnover Ratio is calculated by dividing the companys net annual sales by its average working capital. 420000 60000.

Now working capital Current assets Current liabilities. Heres the formula to calculate a construction companys working capital turnover. Net Working Capital Current assets Current liabilities.

In other words it displays the relationship between the funds used to finance the companys operations and the revenues the company generates as a result. Current Assets 10000 5000 25000 20000 60000. The working capital turnover ratio is used by a companys management team investors andor creditors to determine how efficiently and effectively the company uses its assets.

The formula for calculating this ratio is by dividing the companys sales by the companys working. Working capital turnover is a ratio that measures how efficiently a company is using its working capital to support sales and growth. An unchanged Working Capital Turnover may indicate the companys ability to generate sales from its Working Capital has remained the same.

Putting the values in the formula of working capital turnover ratio we get. Candidates should understand how to calculate and interpret the working capital turnover ratio. Working capital turnover Annual Revenue Average Working Capital.

The higher the ratio the better. WC Turnover Ratio Revenue Average Working Capital. The working capital turnover calculator helps in determining the efficient working of this by the management.

To arrive at the average working capital you can sum. If it is less than 1 It is known as negative working capital which generally means that the company cannot pay. That figure is higher for general construction businesses.

Working capital turnover is a ratio that quantifies the proportion of net sales to working capital and it measures how efficiently a business turns its working capital into increased sales numbers. This means that for every 1 spent on the business it is providing net sales of 7. The formula to measure the working capital turnover ratio is as follows.

The working capital turnover ratio reveals the connection between money used to finance business operations and the revenues a business produces as. The calculation of its working capital turnover ratio is. This is a topic that is often tested on the BEC section of the CPA exam.

Working capital Turnover ratio Net Sales Working Capital. Generally a higher ratio is better and suggests that the company does not require more funds. The day-to-day operations can be determined by the Working capital formula ie.

The basic calculation of working capital is based on the entitys gross current assets. Working capital refers to the money your business has available to spend on essential payments operations etc. Working Capital Turnover Ratio Example Calculation.

For construction businesses working capital turnover typically falls somewhere between 3 and 7. Working capital turnover ratio is an analytical tool used to calculate the number of net sales generated from investing one dollar of working capital.

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Asset Turnover Ratio Formula Calculator Excel Template

How To Calculate Working Capital Turnover Ratio Flow Capital

Asset Turnover Ratio Formula And Excel Calculator

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Calculator

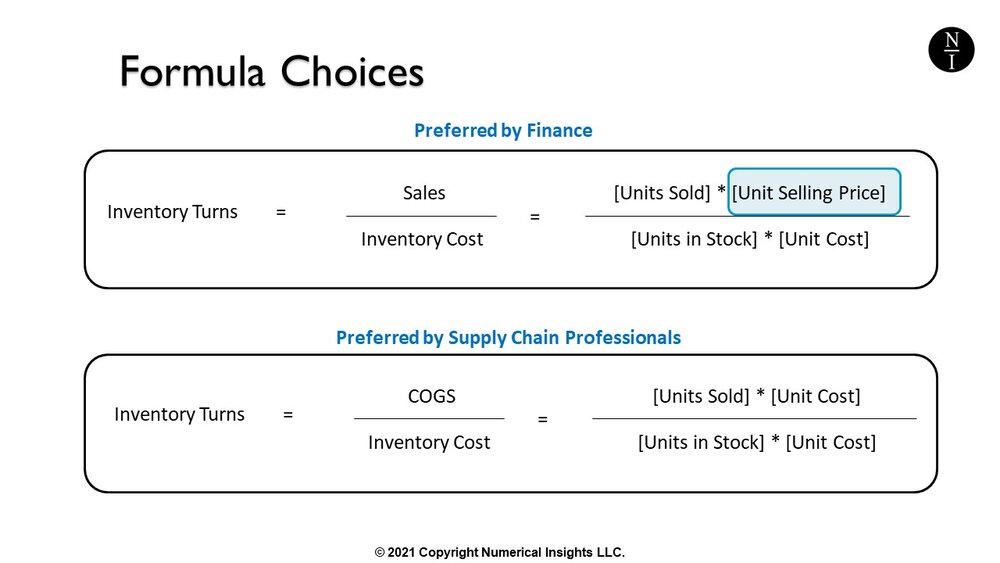

Formula To Calculate Inventory Turns Inventory Turnover Rate

How To Find Net Working Capital Formula

Activity Ratio Formula And Turnover Efficiency Metrics

Fixed Asset Turnover Ratio Formula Calculator Example Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

Capital Turnover Definition Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula And Calculator

Efficiency Ratios Archives Double Entry Bookkeeping